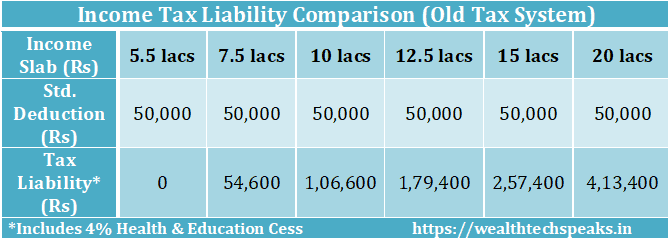

Income Tax Calculation Fy 2020-21 | Budget 2020, bring two tax regimes, somehow benefit certain income taxpayers and drag additional tax from certain taxpayers. Tax on retirement benefits click here. What has happened is the budget has given one more option to calculate your taxes. Unfortunately, this is far from truth. With new union budget rules and regulations, your itax calculation has to consider not just how much income tax from salary you would have to pay in the old regime but also in the new regime. February 19, 2020 at 8:36 pm cancel reply leave a comment. This calculator is designed to work with both old and new tax slab rates released in the budget 2020. While the due date has been extended till 30 september 2021, it is never too early to know your tax liability. Both old and new tax regimes require a proper assessment before choosing one. Budget 2020, bring two tax regimes, somehow benefit certain income taxpayers and drag additional tax from certain taxpayers. Use this easy to use salary tax calculator to estimate your taxes Finance minister in her budget 2020 speech mentioned that she has made the income tax structure simple. In other words, gti less deductions (under section 80c to 80u) = total income (ti). Additionally, health and education cess at 4% are levied on the total tax rate, above the total amount payable. This means that for individuals earning incomes of up to inr 5 lakhs in a financial year, no tax amount would be payable. Calculate your income tax easily using our tool. February 19, 2020 at 8:36 pm cancel reply leave a comment. Learn how to use income tax calculator @ icici prulife. Income tax is due every year for all the individual taxpayers in india. Tax on retirement benefits click here. 4,80,000 people visited this section in last 30 days. Salary, pension, house property (1 sop & 2 lop) along with set off & carry forward of loss therein, and. This calculator calculates income from. Use this easy to use salary tax calculator to estimate your taxes What has happened is the budget has given one more option to calculate your taxes. This means that for individuals earning incomes of up to inr 5 lakhs in a financial year, no tax amount would be payable. This calculator is designed to work with both old and new tax slab rates released in the budget 2020. March 24, 2020 at 4:07 pm madhaba panigri says: It will help you to make an informed decision to opt for a suitable tax structure. 4,80,000 people visited this section in last 30 days. April 18, 2020 at 8:15 pm kartik soni says: With the help of the income tax calculator, you can gauge the impact of both the tax structures on your income. Salary, pension, house property (1 sop & 2 lop) along with set off & carry forward of loss therein, and. While the due date has been extended till 30 september 2021, it is never too early to know your tax liability. Additionally, health and education cess at 4% are levied on the total tax rate, above the total amount payable. Calculate your income tax easily using our tool. The union budget 2020 has left individuals confused with the choice of the tax regime. Presently, taxpayers who are willing to opt for new tax regime are required to intimate pay drawing authority in prior. February 19, 2020 at 8:36 pm cancel reply leave a comment. Finance minister in her budget 2020 speech mentioned that she has made the income tax structure simple. This calculator is designed to work with both old and new tax slab rates released in the budget 2020. March 24, 2020 at 4:07 pm madhaba panigri says: You can calculate your tax liabilities as per old and new tax slab. More option means more complexity. In other words, gti less deductions (under section 80c to 80u) = total income (ti). What has happened is the budget has given one more option to calculate your taxes. Income tax slab and rates for f.y. Calculate your income tax easily using our tool. April 18, 2020 at 8:15 pm kartik soni says: The new regime of taxation is introduced which is optional to an assessee. More option means more complexity. Both old and new tax regimes require a proper assessment before choosing one. 4,80,000 people visited this section in last 30 days. March 24, 2020 at 4:07 pm madhaba panigri says: Budget 2020, bring two tax regimes, somehow benefit certain income taxpayers and drag additional tax from certain taxpayers. This calculator is designed to work with both old and new tax slab rates released in the budget 2020. This calculator is an easy online tool for quick basic calculation and cannot give correct calculation in all circumstances. The union budget 2020 has left individuals confused with the choice of the tax regime. In other words, gti less deductions (under section 80c to 80u) = total income (ti).

Income Tax Calculation Fy 2020-21: March 24, 2020 at 4:07 pm madhaba panigri says:

EmoticonEmoticon